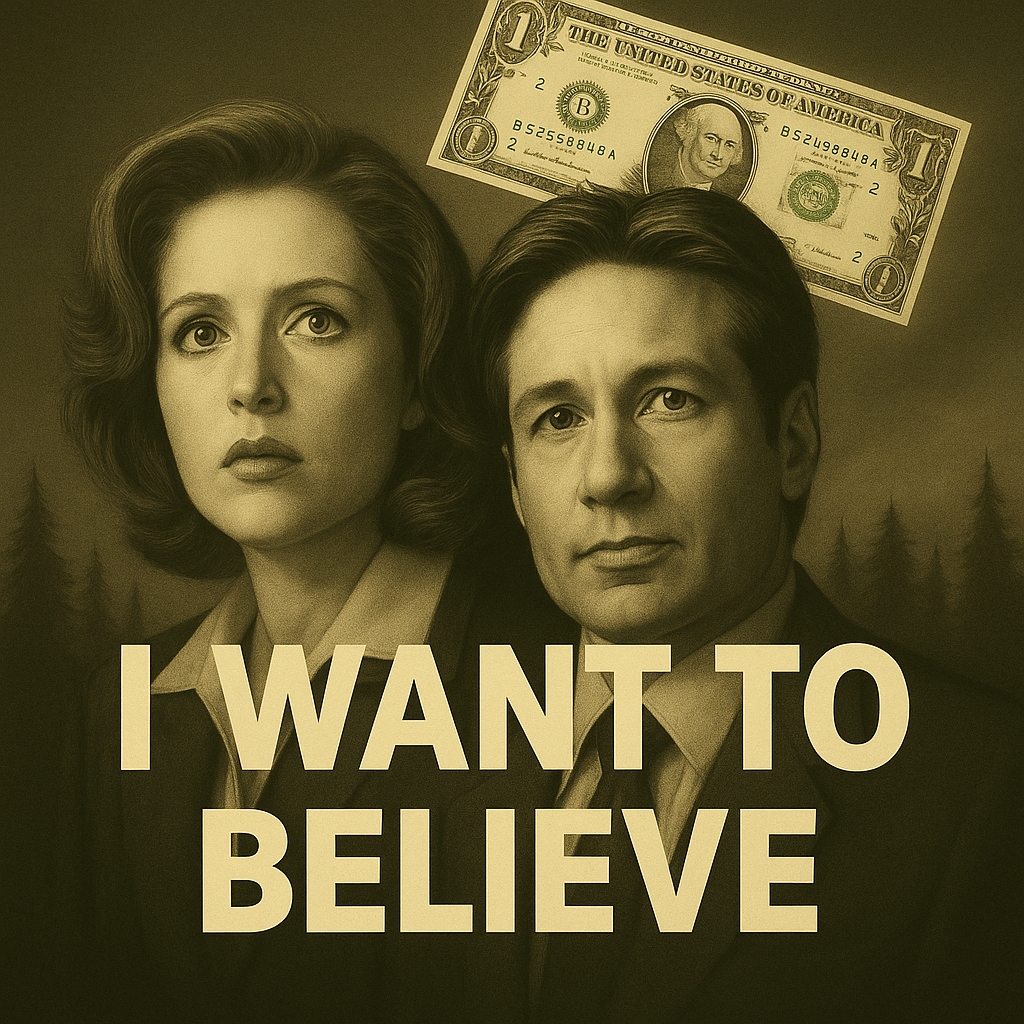

Mulder sat alone in his office. No light, except for a flickering desk lamp and the soft hum of fluorescent fatigue. A thick file lay before him, yellowed with time. It read: “FIAT-404 — Currency Not Found.”

He sighed and whispered to no one, “Scully… I think money might not be real.”

This wasn’t about aliens. It wasn’t about shapeshifters or men with black lungs. This time, the phenomenon was everywhere — in wallets, in banks, in every ATM around the globe. And still, no one questioned it.

It began, as most things do, with trust. Long before central banks and treasury departments, money meant something. It was metal, land, salt — something tangible, finite, hard to fake. Gold didn’t care who was king. Silver didn’t crash on rumors. These things had weight, both physically and economically.

But over time, governments grew tired of restraint. War needed funding, economies needed stimulation, voters needed free stuff. Paper was easier. Trust could be printed — at least for a while.

In the 20th century, fiat currency spread like a virus. Promises replaced backing. Words replaced weight. The United States, once anchored in gold, led the world down this path. The dollar remained dominant, not because it was sound, but because everyone still pretended it was.

Then came 1971 — the year the illusion became policy. Nixon closed the gold window. The dollar would no longer be backed by anything except belief. From that moment on, all major currencies were just paper, and the global economy was built on faith.

But faith alone wouldn’t hold. So the Petrodollar was born. The US made a deal with oil-rich nations: sell oil in dollars, and we’ll protect you. Every country, needing energy, needed dollars. And just like that, the dollar became the world’s unofficial god.

No one voted for this system. It just happened. It was efficient. Elegant. Dangerous.

Other nations followed. Europe. Japan. China. Latin America. All of them embraced fiat money like a religion — each central bank its own high priest, each inflation rate a silent tax.

But over time, belief began to crack. Weimar. Zimbabwe. Argentina. Venezuela. Lebanon. Turkey. Sri Lanka. Currency crises came and went like seasonal storms. The symptoms differed; the root cause never did.

Everywhere fiat has been tried, it has failed — slowly, then suddenly. Not because of conspiracy, but because of math. Fiat money depends on governments exercising restraint. And history has proven they never do.

Now, in the early 21st century, something new is happening. Quiet exits. People walking away from the illusion. They don’t riot. They don’t protest. They buy Bitcoin. They buy gold. They buy land. They opt out, not with slogans, but with code.

Mulder stared at a crumpled dollar bill. He held it to the light, inspecting the all-seeing eye. “It’s not money,” he muttered. “It’s a story.”

Scully raised an eyebrow. “And do you still want to believe?”

He folded the bill into a paper plane and tossed it toward the filing cabinet marked “UNSOLVED.”

“No,” he said. “Not in them. Not anymore.”