Michael Saylor: From Dot-Com Disaster to Digital Gold Disciple

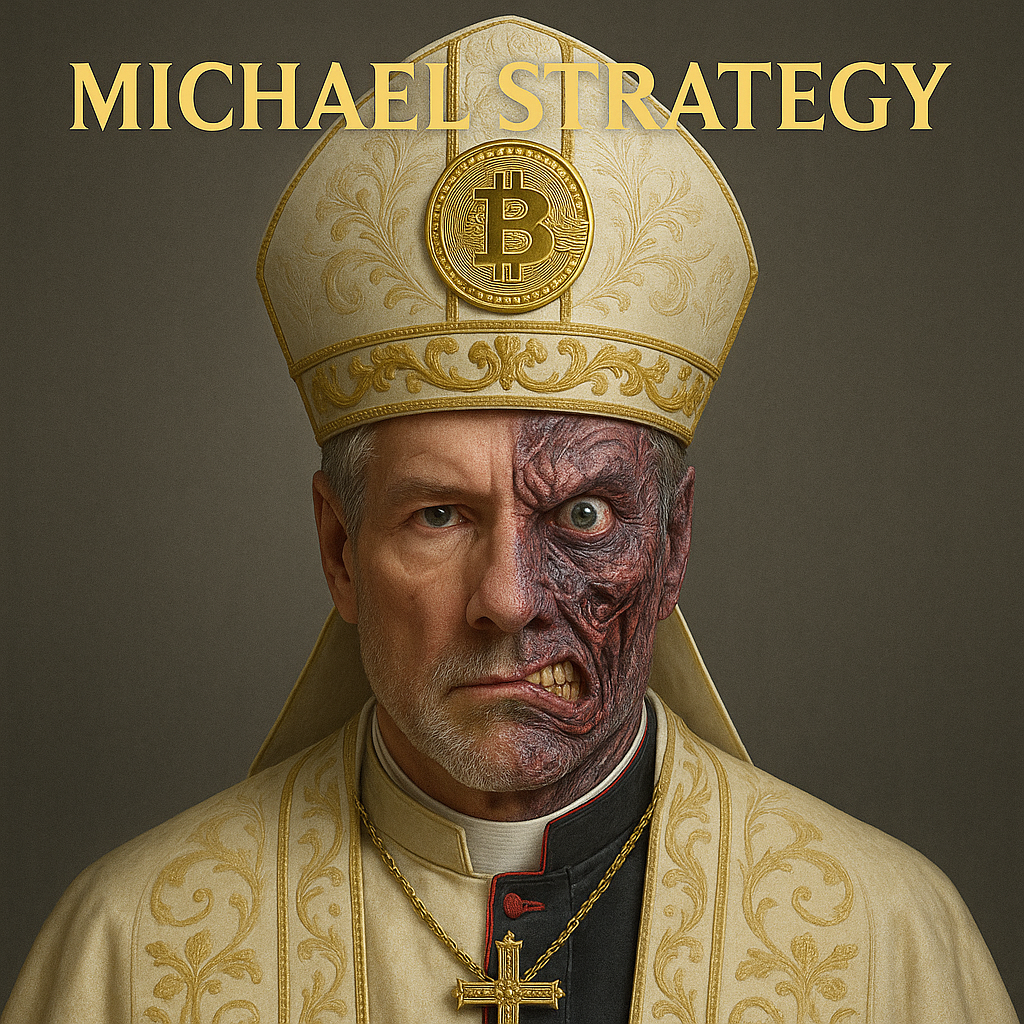

Once hailed as a tech visionary, then publicly flogged by Wall Street, and now reborn as the high priest of Bitcoin—Michael Saylor’s career arc reads like a Greek tragedy rebooted for the crypto age. Only this time, the toga is optional, and the temple accepts Lightning payments.

Let’s rewind. It’s the year 2000. MicroStrategy, Saylor’s data analytics firm, is flying high—until it isn’t. Turns out, reporting imaginary revenue doesn’t go over too well with the SEC. The fallout? A 62% stock crash in one day, $6 billion in shareholder value vaporized, and a personal wealth haircut that would make even Samson weep. Saylor settled the accounting fraud case for $8.3 million—pocket change if you’re playing billionaire bingo.

But fast-forward two decades, and there he is again—suit pressed, eyes blazing, telling anyone with a Wi-Fi connection that Bitcoin is the future of civilization and the only way out of fiat hell. Suddenly, MicroStrategy is no longer an enterprise software company—it’s a Bitcoin ETF with a Nasdaq ticker.

Was it a genuine philosophical awakening or a calculated PR resurrection? Hard to say. What we do know is this: in 2020, while the rest of the world was hoarding toilet paper, Saylor began hoarding Bitcoin. Lots of it. As of 2025, MicroStrategy holds nearly half a million BTC—more than most sovereign nations—and paid roughly $28 billion for the privilege.

Some called it visionary. Others called it unhinged. But Saylor leaned all the way in. He wasn’t just buying Bitcoin—he was proselytizing. Tweets, interviews, podcasts, keynotes—if it had a microphone, Saylor showed up with digital fire and brimstone. Central banks? Corrupt. Fiat? Decaying. Bitcoin? The thermodynamic miracle of our time.

Of course, not everything was moon and memes. In 2024, Saylor was slapped with a $40 million tax fraud settlement by the District of Columbia. The alleged crime? Pretending he didn’t live in DC while living very much in DC. For a guy who champions self-sovereignty and transparency, it was an awkward plot twist.

Still, the Bitcoin crowd crowned him king. Saylor became the de facto Messiah of the Maxis—a crusader against the fiat machine, part warrior monk, part leveraged bull. Whether by redemption or reinvention, he’d found a new gospel, and this time he wasn’t just selling software—he was selling salvation.

So, what’s the endgame? Is Michael Saylor a misunderstood genius playing fourth-dimensional chess? A true believer in a better monetary system? Or just a remarkably adaptable brand manager who knows how to surf the next wave before it crashes?

Quo vadis, Michael Strategy?